Top executives helping

successful startups grow

Angel Trends and Returns

There are a number of megatrends that are important to understand in successful angel investing. No individual can be an expert at every industry, so investing with many other top executives with diverse backgrounds in Executive Angels is invaluable. According to every published study (many listed below), Angel Groups have outperformed individual angels and venture firms by a considerable margin. There are many reasons for this, some of the most important trends include:

1. The Angel Asset Class is Growing Rapidly.

The Angel Asset Class now exceeds $22 Billion as compared to the Venture Capital Asset Class which raised just $18 Billion last year (NAVC and Center for Venture Research). There are may reasons for this but the primary drivers are the lack of profits within most venture funds averaging less than a 5% IRR (Cambridge Associates 5 Year Horizon as of 6/2012) and exceptional returns from a very few high profile startups that caught the attention of many high net worth investors. Unfortunately, average angel returns are no better than venture returns (also less than 5% per the Center for Venture Research). One exception to this is Angel Groups which represent around 4% of total angel investing. Angel Groups have averaged a remarkable 27% IRR for a number of years according to most studies (Wiltbank & Boeker Study:

The Angel Asset Class now exceeds $22 Billion as compared to the Venture Capital Asset Class which raised just $18 Billion last year (NAVC and Center for Venture Research). There are may reasons for this but the primary drivers are the lack of profits within most venture funds averaging less than a 5% IRR (Cambridge Associates 5 Year Horizon as of 6/2012) and exceptional returns from a very few high profile startups that caught the attention of many high net worth investors. Unfortunately, average angel returns are no better than venture returns (also less than 5% per the Center for Venture Research). One exception to this is Angel Groups which represent around 4% of total angel investing. Angel Groups have averaged a remarkable 27% IRR for a number of years according to most studies (Wiltbank & Boeker Study:  Returns to Angel Investors in Groups).

Returns to Angel Investors in Groups).2. Returns from Angel Groups are Higher Than Angel or Venture Averages.

There are a number of reasons but the most important include:a) Good Deal Flow. With so many high net worth angels in a group they naturally attract a far larger funnel of deals than any single angel or VC could typically source so more choices,

b) Industry Knowledge. Because of their varied backgrounds and heavy experience across so many industries groups are usually able to make better informed decisions than any single individual investor could,

c) Ample Due Diligence. as a team they usually perform far more diligence than a single angel investor commonly performs, and

d) Follow-up. a large amount of time is collectively spent among all the angel group members mentoring and following up with the invested companies as their expertise is needed.

Also keep in mind that not every angel group is profitable -- many have had few or no exits (or it is too early for them to have had exits because they recently started) and some angel groups don't always follow these key success factors so picking an angel group with an excellent strategy and good execution is critical.

3. Angels Now Capture More Exits than Venture Firms.

In 2012 over 76% of acquired tech companies did not raise any venture capital ( CB Insight Study). Most companies now go from Angel-to-Exit and skip the VC process entirely, leaving all of the profits to the founders and angels. More than 50% of deals are less than $50M in size, and more than 80% of the acquisitions are less than $200M in size. This translates into a high number of diversified deals with mostly singles and doubles still in their early stages at the time of the exit. This also explains the shorter hold times of angels compared to venture firms, and far higher returns for angel groups that can pick well compared to most venture firms.

CB Insight Study). Most companies now go from Angel-to-Exit and skip the VC process entirely, leaving all of the profits to the founders and angels. More than 50% of deals are less than $50M in size, and more than 80% of the acquisitions are less than $200M in size. This translates into a high number of diversified deals with mostly singles and doubles still in their early stages at the time of the exit. This also explains the shorter hold times of angels compared to venture firms, and far higher returns for angel groups that can pick well compared to most venture firms.4. Key Advantages of Executive Angels.

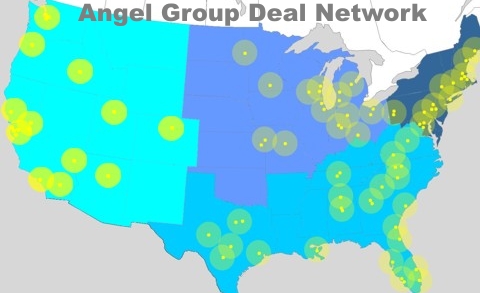

We focus heavily on the key factors listed above and try to improve on them:a) Better Deal Flow. While most angel groups screen around 200-300 possible investments a year, we have assembled a syndication system of over 200 angel groups screening deals (around 23,000 a year) who then share with us many of their best deals so Executive Angels has a far larger funnel of deals than any other organization,

b) Industry Knowledge. Because we leverage the syndication system above, there are over 5,000 angels in the 200+ angel groups whose industry knowledge we are leveraging,

c) Ample Due Diligence. We mostly only co-invest with other angel groups in a deal so that is double due diligence (once by the angel group leading the deal and a second time by us) using unique processes to ensure we look at many additional critical factors, and

d) Follow-up. Again because we mostly co-invest with other angel groups they have typically assigned one or more members to help and mentor that company and we often also get involved in helping that company as well which provides additional follow-up.

Trends and Returns

Trends and Returns